Securitize, Mantle launch institutional crypto fund

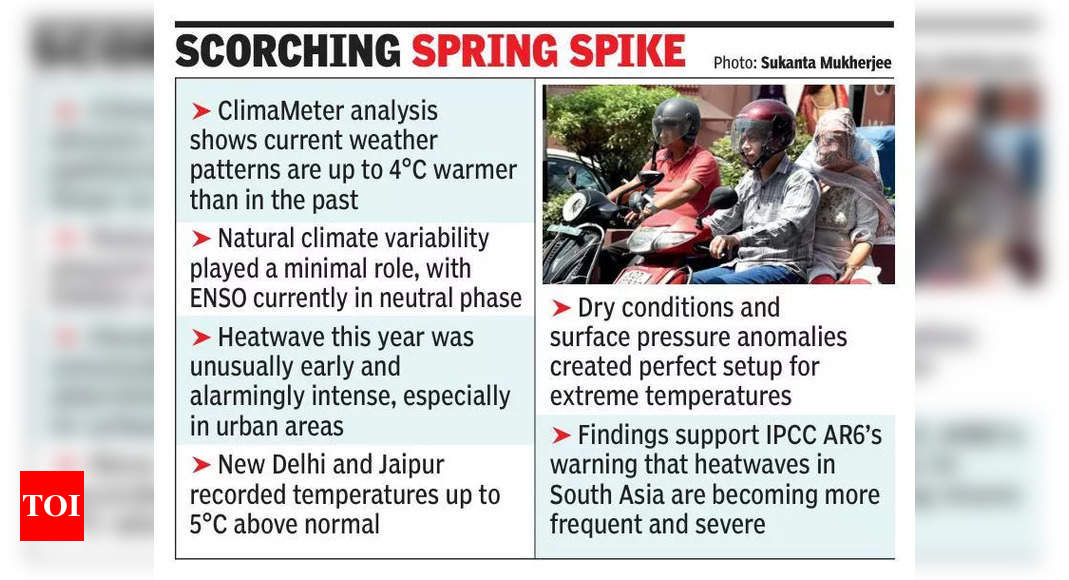

Tokenization platform Securitize has partnered with decentralized finance (DeFi) protocol Mantle to launch an institutional fund designed to earn yield on a diverse basket of cryptocurrencies, the companies said. Similar to how a traditional index fund tracks a mix of stocks, the Mantle Index Four (MI4) Fund aims to offer investors exposure to cryptocurrencies, including Bitcoin (BTC), Ether (ETH), and Solana (SOL), as well as stablecoins tracking the US dollar, Securitize said in an April 24 announcement. The fund also integrates liquid staking tokens — including Mantle’s mETH, Bybit’s bbSOL, and Ethena’s USDe — in a bid to enhance returns with onchain yield, according to the announcement.The launch comes as retail and institutions alike increase exposure to cryptocurrencies, particularly Bitcoin, as a hedge amid escalating macroeconomic uncertainty. Mantle’s mETH yields 3.78%. Source: DeFILlama‘S&P 500 of crypto’The market capitalization-weighted index fund aspires to “become the de facto SPX or S&P 500 of crypto,” Timothy Chen, Mantle’s global head of strategy, said in a statement. The company offers institutions a way to generate yield from digital assets. One of its liquid staking products, Mantle Staked Ether (mETH), yields holders approximately 3.78% APR as of April 24, according to data from DefiLlama. The protocol has more than $680 million in total value locked (TVL). Securitize is the most popular institutional tokenization platform. Source: RWA.xyzSecuritize is one of the most popular platforms for tokenizing real-world assets (RWAs) for institutions, with approximately 71% of market share as of April 24, according to data from RWA.xyz. Its largest affiliated fund — BlackRock Institutional Digital Liquidity Fund (BUILD) — has more than $2.5 billion in net assets.In March, Securitize co-founder and CEO Carlos Domingo told Cointelegraph that demand for tokenized funds is accelerating as “[i]nstitutional investors, private equity firms, and credit managers [turn] to tokenization to enhance efficiency, reduce operational friction, and improve liquidity.”Magazine: What are native rollups? Full guide to Ethereum’s latest innovation

Tokenization platform Securitize has partnered with decentralized finance (DeFi) protocol Mantle to launch an institutional fund designed to earn yield on a diverse basket of cryptocurrencies, the companies said.

Similar to how a traditional index fund tracks a mix of stocks, the Mantle Index Four (MI4) Fund aims to offer investors exposure to cryptocurrencies, including Bitcoin (BTC), Ether (ETH), and Solana (SOL), as well as stablecoins tracking the US dollar, Securitize said in an April 24 announcement.

The fund also integrates liquid staking tokens — including Mantle’s mETH, Bybit’s bbSOL, and Ethena’s USDe — in a bid to enhance returns with onchain yield, according to the announcement.

The launch comes as retail and institutions alike increase exposure to cryptocurrencies, particularly Bitcoin, as a hedge amid escalating macroeconomic uncertainty.

‘S&P 500 of crypto’

The market capitalization-weighted index fund aspires to “become the de facto SPX or S&P 500 of crypto,” Timothy Chen, Mantle’s global head of strategy, said in a statement.

The company offers institutions a way to generate yield from digital assets. One of its liquid staking products, Mantle Staked Ether (mETH), yields holders approximately 3.78% APR as of April 24, according to data from DefiLlama. The protocol has more than $680 million in total value locked (TVL).

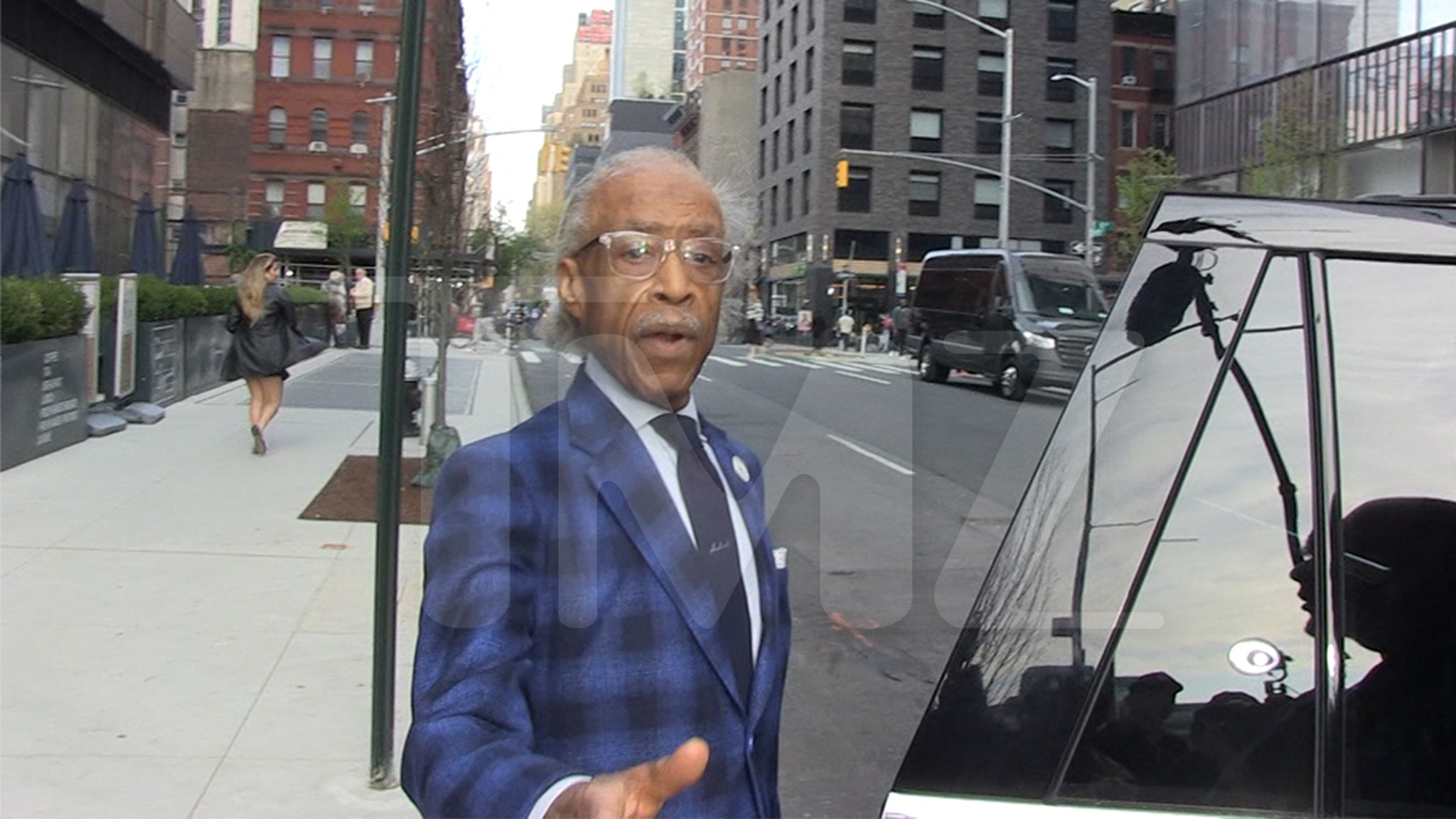

Securitize is one of the most popular platforms for tokenizing real-world assets (RWAs) for institutions, with approximately 71% of market share as of April 24, according to data from RWA.xyz. Its largest affiliated fund — BlackRock Institutional Digital Liquidity Fund (BUILD) — has more than $2.5 billion in net assets.

In March, Securitize co-founder and CEO Carlos Domingo told Cointelegraph that demand for tokenized funds is accelerating as “[i]nstitutional investors, private equity firms, and credit managers [turn] to tokenization to enhance efficiency, reduce operational friction, and improve liquidity.”

Magazine: What are native rollups? Full guide to Ethereum’s latest innovation

What's Your Reaction?