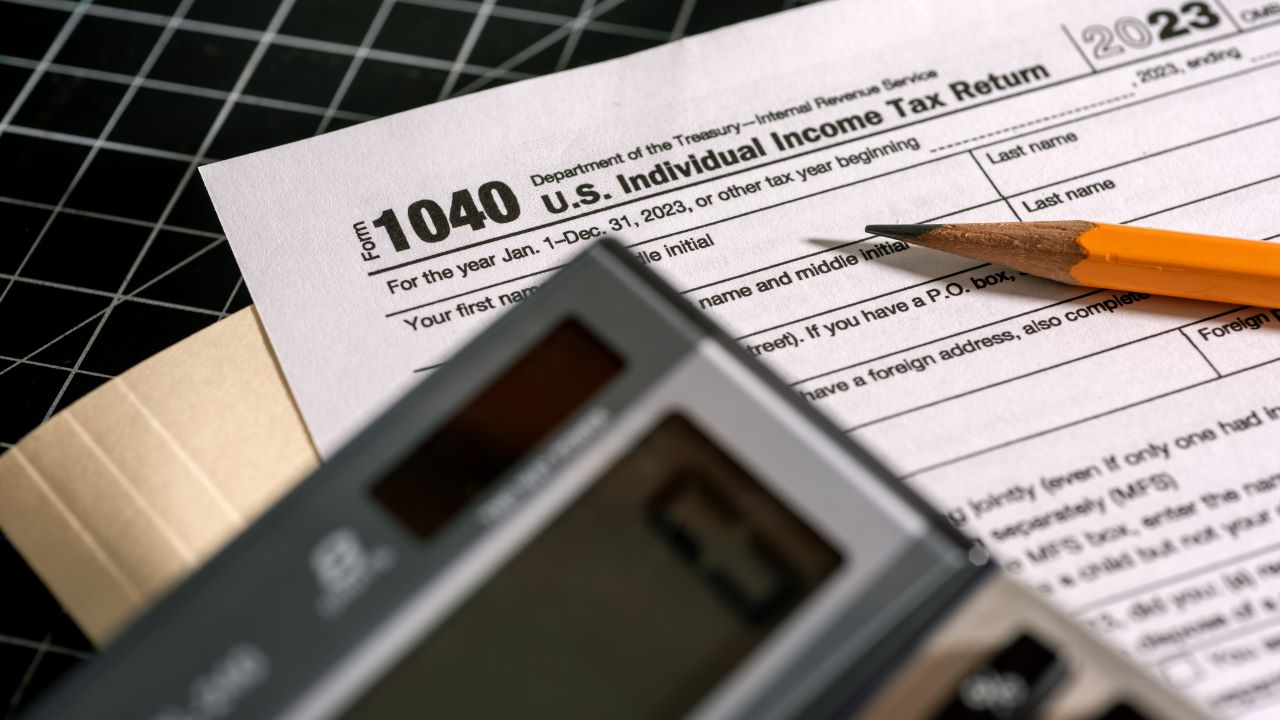

It's Tax Day: Need to file an extension? Today's the deadline

Tax Day arrives on April 15, and taxpayers have a deadline of midnight to file their return or request an extension from the IRS. But that does not extend tax payment deadlines.

Tax Day arrived on Tuesday with Americans facing a midnight deadline to file their tax returns. However, if they need more time, they can file an extension and get a reprieve until later this year.

Taxpayers have until midnight on Tuesday in their respective time zones to file their returns for the 2024 tax year. Still, if a taxpayer needs more time to file, they can request an extension from the Internal Revenue Service (IRS) to Oct. 15 by using Form 4868. People can file electronically or they can send the form in the mail postmarked by today, April 15.

And it is important to note that people are still on the hook for any taxes owed as of April 15 and should be prepared to pay now to avoid penalties and interest. An expert said that failing to pay on time is nowhere near as bad as failing to file on time.

Andy Phillips, vice president of the Tax Institute at H&R Block, told FOX Business that "if you do need more time past April 15, it's crucial to request an extension. The penalty for failing to file on time is up to 10 times the penalty for just failing to pay on time."

"If you request an extension and expect to owe, it's important to remember that it's an extension of time to file, not an extension of time to pay," Phillips said. "When you submit that extension, make sure you also make a payment of what you expect to owe to avoid penalties and interest."

TIME IS RUNNING OUT FOR TAXPAYERS TO CLAIM $1B IN REFUNDS FROM 2021

"Taxpayers who need more time to complete their taxes can file for an extension electronically or by mail by submitting Form 4868 with the IRS. A tax pro can also help with filing an extension," Phillips said. "The cost for an extension depends on the method and software you're using."

"People that are getting a refund, they will not get those penalties," Lisa Greene-Lewis, a CPA and editor of the TurboTax blog, told FOX Business. "You do still want to file an extension even if you're going to get a refund because the IRS, they don't know your deductions and credits."

"They get a report of your income on forms like W-2 and 1099, and if they don't know what your deductions and credits are, they may send you a notice saying, 'Hey, we see you know this amount.' Now that doesn't mean that you don't necessarily have to pay that amount that they're showing, you would just file your tax return and prove that you don't owe that amount," she explained.

AMERICANS' TAX REFUNDS LARGER THAN LAST YEAR SO FAR: IRS

Greene-Lewis said that while taxpayers who expect to owe the IRS money should make a payment at the time of filing their extension, they can work with the agency through a payment plan if they need to.

"The IRS, they do work with you. They'll let you do an installment agreement, which lets you pay what you owe over six years," she explained.

Greene-Lewis and Phillips agreed that taxpayers who have the documents they need should go ahead and file their return ahead of the midnight deadline, instead of requesting an extension and drawing out the process.

TAX EXPERT SHARES LAST-MINUTE FILING TIPS TO MINIMIZE HEADACHES AND MAXIMIZE YOUR RETURN

"If you're ready to go and have all your documents, there's no reason to wait any longer. Make sure you file today," Phillips said.

"The average refund is over $3,000, so why wait if you're going to get a refund for sure. And if you have all your documents, you should just go ahead and file; you have until midnight for the tax deadline," Greene-Lewis said. She added that TurboTax's experts are able to handle filing taxes in as little as a day and will be available until midnight local time on Tax Day.

What's Your Reaction?