Coinbase invests in Canadian stablecoin issuer

Coinbase has partnered with Canadian stablecoin issuer Stablecorp in a bid to expand access to tokenized Canadian dollars, a company executive told Cointelegraph during the Blockchain Futurist Conference in Toronto.According to Coinbase Canada's CEO, Lucas Matheson, the exchange is investing an undisclosed amount in Stablecorp and will help market its fiat-collateralized stablecoin, QCAD. “It’s really important that we have a stablecoin for Canadians,” Matheson told Cointelegraph in an exclusive interview on May 13, adding that stablecoins are especially urgent because the country has “no peer-to-peer [payment] rail” and “wire transfers cost $45 and take 45 minutes of paperwork.”“With stablecoins, 24/7, instant, borderless payments become possible — this is already feasible with existing tech,” he said. Lucas Matheson (left) and Sam Bourgi (right) on the sidelines of the Futurist Conference in Toronto. Source: CointelegraphRelated: What Canada’s new Liberal PM Mark Carney means for cryptoBarriers to adoptionAs of May 13, stablecoins have an aggregate market capitalization of around $245 billion, primarily comprising US dollar-backed stablecoins Tether (USDT) and USDC (USDC), according to data from CoinGecko.Stablecorp’s most recent report on QCAD’s fiat reserve backing dates to July 2024, at which time only around $175,000 worth of QCAD were in circulation, according to its website.Stablecorp’s flagship product is QCAD, a fiat-backed stablecoin. Source: StablecorpHowever, “Canada lacks a clear path for stablecoin adoption” in part because its government has yet to “remove securities regulation barriers for fiat-backed stablecoins,” Coinbase said in a March 26 blog post. It needs to begin “treating them as payment instruments rather than securities,” the exchange added.In April, the US SEC said that stablecoins do not qualify as securities in the country if they are marketed solely as a means of making payments."We’re asking the federal government to develop a national strategy for digital assets. Crypto is strategic, and we hope this new administration sees that,” Matheson said. Canada elected Prime Minister Mark Carney during its federal elections in April. Carney has historically been critical of cryptocurrency. Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race

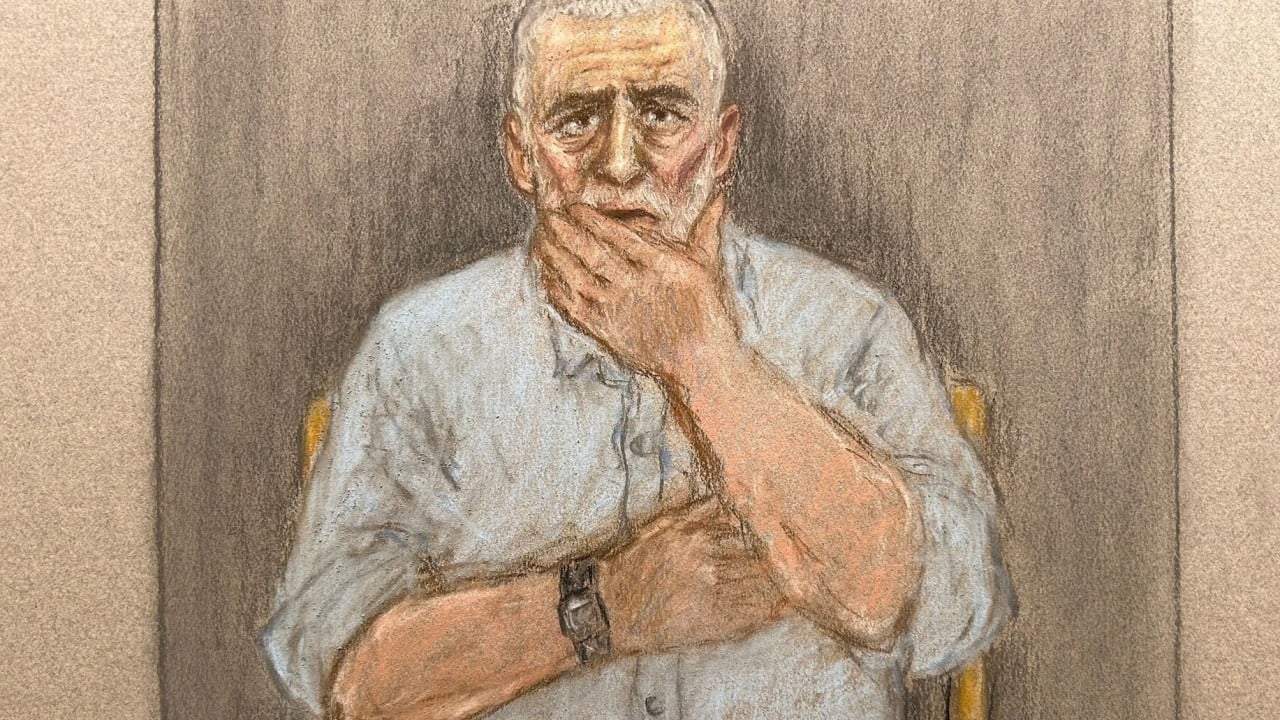

Coinbase has partnered with Canadian stablecoin issuer Stablecorp in a bid to expand access to tokenized Canadian dollars, a company executive told Cointelegraph during the Blockchain Futurist Conference in Toronto.

According to Coinbase Canada's CEO, Lucas Matheson, the exchange is investing an undisclosed amount in Stablecorp and will help market its fiat-collateralized stablecoin, QCAD.

“It’s really important that we have a stablecoin for Canadians,” Matheson told Cointelegraph in an exclusive interview on May 13, adding that stablecoins are especially urgent because the country has “no peer-to-peer [payment] rail” and “wire transfers cost $45 and take 45 minutes of paperwork.”

“With stablecoins, 24/7, instant, borderless payments become possible — this is already feasible with existing tech,” he said.

Related: What Canada’s new Liberal PM Mark Carney means for crypto

Barriers to adoption

As of May 13, stablecoins have an aggregate market capitalization of around $245 billion, primarily comprising US dollar-backed stablecoins Tether (USDT) and USDC (USDC), according to data from CoinGecko.

Stablecorp’s most recent report on QCAD’s fiat reserve backing dates to July 2024, at which time only around $175,000 worth of QCAD were in circulation, according to its website.

However, “Canada lacks a clear path for stablecoin adoption” in part because its government has yet to “remove securities regulation barriers for fiat-backed stablecoins,” Coinbase said in a March 26 blog post. It needs to begin “treating them as payment instruments rather than securities,” the exchange added.

In April, the US SEC said that stablecoins do not qualify as securities in the country if they are marketed solely as a means of making payments.

"We’re asking the federal government to develop a national strategy for digital assets. Crypto is strategic, and we hope this new administration sees that,” Matheson said.

Canada elected Prime Minister Mark Carney during its federal elections in April. Carney has historically been critical of cryptocurrency.

Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race

What's Your Reaction?